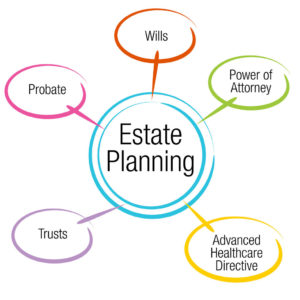

Drafting a Trust in Estate Planning is an essential part of an updated Estate Plan in Oklahoma. The largest age demographic in America today is the Baby Boomer generation. This generation is also in the process of aging into their senior years. As a result, many people of the Baby Boomer generation are creating an estate plan. Creating a trust is a significant part of the estate planning process. This article will explain more about trusts and which could work best for your situation.

What To Choose When Drafting a Trust in Estate Planning

-

Revocable Trust

When creating a trust, most lawyers will encourage you to consider a revocable trust. This is because it provides you with the flexibility and control most people wish to keep over their assets. You can amend or change the terms of the trust at any moment. Further, you can terminate the trust at any point you wish as well. However, the trust is set and becomes irrevocable upon your death. Additional concerns are with the ability of creditors to reach the corpus of the Trust.

most people wish to keep over their assets. You can amend or change the terms of the trust at any moment. Further, you can terminate the trust at any point you wish as well. However, the trust is set and becomes irrevocable upon your death. Additional concerns are with the ability of creditors to reach the corpus of the Trust.

-

Irrevocable Trusts

Creating an irrevocable trust is not common, nor do lawyers generally encourage it. This is due to the fact that irrevocable trusts are extremely difficult to amend or terminate once in existence. However, if you are relatively wealthy and wanting to donate money to a charity, then this may be the trust for you. An irrevocable trust entirely divorces the assets in the trust from your estate. This means you will no longer pay taxes on the assets. But, you can still earmark and set out parameters of use regarding the assets. In many instances an irrevocable Trust puts your assets beyond the reach of many of your creditors.

-

Testamentary Trusts

Creating a trust in your will that becomes effective upon your death is a testamentary trust. In many cases people will use these for grandchildren or other minor children they wish to provide for after their death. You can set parameter to how the money or assets are doled out. For instance, you can leave the assets in the trust with only a certain amount being available to the beneficiary each month if you wish. This provides a steady income stream and discourages squander.

-

Intervivos Trusts

Living trusts, or intervivos trusts, are trust set up while you are still living. Further, this trust is generally revocable and you can be the primary trustee of the account. As a result, you can administer the trust assets to your liking. You must have a specific purpose and terms in order to create an intervivos trust.

QUESTIONS ON STEP-CHILDREN AND INHERITANCE? SEE OUR BLOG POST FOR MORE INFO.

Setting Up Your Trust

The process of Drafting a Trust in Estate Planning doesn’t have to so difficult. To begin with you simply must fill out a trust document with your name and the name of the beneficiary and sign it in front of a notary. Then, you will transfer the assets you wish to be in the trust to the trust. However, this process has many tedious rules that could cause significant issues when the trust is administered if they are not completed in the proper manner. Additionally there are certain transfers that may impact your Estate Taxes and other considerations.

Our experienced Creek County Attorneys can help you in Drafting a Trust in Estate Planning. If you know how you want your assets handled after you die we can help you get it done. The process doesn’t have to be so hard so long as you get it started and get a little help.